santa clara property tax due date

Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. In accordance with Government Code 29802 any funds that remain unclaimed for more than two years will be removed from the list and transferred to the Countys general fund.

518-481-1600 or 518-481-1502 front desk Fax.

. Our property tax data is based on a 5-year study of median property tax rates conducted from 2006 through 2010. The property tax refunds become unclaimed due to various reasons such as returned mail uncashed checks refusal of the funds or lack of response from notifications. Please visit the Proposition 19 webpage for more information on the operative base year value transfers for persons age 55 and over.

Real Property Tax Service - Department 10 About the Department. Property taxes are calculated by multiplying your municipalitys effective tax rate by the most recent assessment of your property. The home must have been the principal place of residence of the owner on the lien date January 1st.

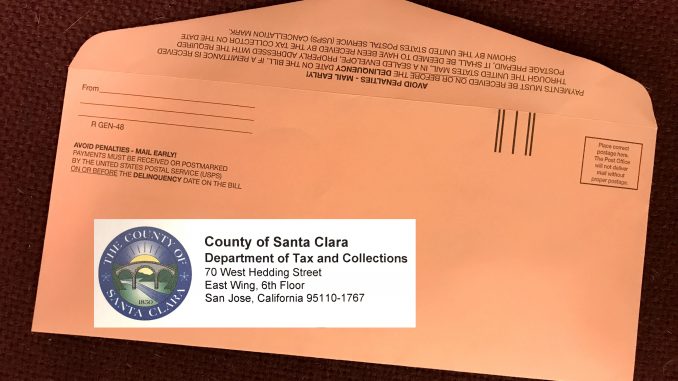

County of Santa Clara Government Center 70 West Hedding Street East Wing 8th Floor San Jose CA 95110 408 299-5830 ESA-HR at Santa Clara Valley Health and Hospital System 2325 Enborg Lane Suite 1H105 San Jose CA 95128 408 885-5450 408 885-5461 ESA-HR at Social Services Agency 333 W. Any adjustments will be carried out via the supplemental process. Due to the COVID-19 pandemic.

Report a Possible Violation How to report a possible violation in the Unincorporated area of Santa Clara County. Propositions 6090 amended section 2. Our Mission Secure preserve and make accessible the countys vital business and official records through maximized use of technology.

If you have purchased a replacement property in Santa Cruz County and have sold your original property please complete the appropriate application form see the All Forms Page. While working together in the pursuit of excellence in customer service. Repayment of all taxes is due when the property is sold or title is transferred.

Census Bureau American Community Survey 2006-2010. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to. David Bethel was a senior appraiser in the Santa Clara County Assessors Office before retiring after a 20-year career of public service.

355 West Main St. The schedule must include the date and value of the asset distributed at its appraised value. This dashboard shows the 7-day daily average COVID-19 case rate by day for Santa Clara County overall for unvaccinated residents and for fully vaccinated residents.

Tax bills are mailed and due upon receipt. Census Bureau American Community Survey 2006-2010. This definition differs from the definition used by the Medical Examiner-Coroners Office ME-C primarily due to the ME-C counting deaths that occur in Santa Clara Countyincluding residents and nonresidentswhereas the County of Santa Clara Public Health Department counts deaths that occur among Santa Clara County residents including.

But we would have ended up with a much more equitable property tax system once the initial. Lien Datethe day your propertys value is assessed. Then a senior lien is placed on the property.

Franklin County Real Property Tax Services Contact. And he was correct. Make a Virtual Appointment or Inquiry Make an appointment for virtual consultation with a planner or development engineer.

Effective April 1 2021 Proposition 19 provisions potentially affect the former base year value transfers for persons age 55 and over that were added by Propositions 60 1986 and 90 1988. PROPERTY TAX ASSISTANCE PROGRAM. To facilitate your payment and billing for Services facilitate payroll and tax Services for our Customers and detect and prevent fraud.

Please note Prop 19 base year value transfers will not change the 202122 annual tax bills. To obtain the postponement an applicant must submit a claim to the state controller s office. San Jose CA 95110 408 755-7130.

All accrued sums on or before the payment due date for the accrued sums. A Receipt on Distribution should also be signed by the person receiving the property and filed with the court as proof that the property was in fact distributed and received by the person entitled to it. Santa Clara Countys Clerk-Recorders Official Records search from 1981 to present can be performed here.

Suite 251 Malone NY 12953 Phone. The claim form BOE-266 Claim for Homeowners Property Tax Exemption is available from the county assessor. The Add-On Service Subscription Term is a continuous and non.

Make sure you review your tax card and look at comparable homes. To claim the exemption the homeowner must make a one-time filing with the county assessor where the property is located. Interest is charged on the postponed taxes and is added to the amount of the lien.

County of Santa Clara. This dashboard provides the cumulative count of COVID-19 variants that have been identified and reported in Santa Clara County to date. Develop or Improve a Property Rules and guidelines for developing or improving a property.

October Tax bills are mailed. Huge amounts of work by assessors offices.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Payment Information For Santa Clara County Property Tax Due Dates

County Of Santa Clara California Santa Clara County S First Installment Of 2019 2020 Property Taxes Are Due Starting Today November 1 Unpaid Property Taxes Become Delinquent If Not Paid By 5 P M

Property Taxes Department Of Tax And Collections County Of Santa Clara

When Are Property Taxes Due In Santa Clara County Valley Of Heart S Delight Blog

First Installment Of The 2021 2022 Annual Secured Property Taxes Due By December 10 And Becomes Delinquent After 5 P M The Bay Area Review

Secured Property Taxes Treasurer Tax Collector

Property Tax Deadlines Andy Real Estate

Op Ed Who S Exempt From Parcel Taxes In Santa Clara County San Jose Inside

Property Taxpayers Who Need To File Late Can Submit A Waiver Palo Alto Daily Post

Santa Clara County Second Installment Of Property Taxes Due By April 11 Ke Andrews

Understanding California S Property Taxes

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara Shannon Snyder Cpas

Payment Information For Santa Clara County Property Tax Due Dates

Property Tax Email Notification Department Of Tax And Collections County Of Santa Clara

Property Taxes Department Of Tax And Collections County Of Santa Clara